Keep your eyes on your long-term business objectives... opportunity awaits!

Published March 18, 2020

Growth Opportunities for Small Builders

As the distress surrounding the COVID-19 outbreak continues to demand your attention every day, don’t take your eye off of your long-term business objectives. For the last ten years the large public national home builders have been growing market share. Prior to the Global Financial Crisis small builders in the aggregate built more than the top 200 builders. Today, the big builders have gained the momentum over small builders. Smaller builders haven’t gotten back into the game. Here lies a great opportunity.

With the housing shortage reaching into over half of all the states according to Freddie Mac Economist Sam Khater, there is abundant opportunity for small builders to grow in markets that don’t have public home builders in the “sandbox.”

Use Housing Tides as a Market Assessment and Planning Tool

Small builders can grow into big builders if they pick the right markets by using analytic tools as found in Housing Tides™. Most of today’s housing giants such as Lennar, Taylor Morrison, KB Home started as small builders and became huge by acquiring other small home builders. Two guys named Leonard and Arnold bought 40 lots in Florida in the 1950’s. Then, eventually became Lennar, today’s powerhouse in the industry.

Use Housing Tides to analyze these markets where the giants don’t operate. Vendors and subcontractors can also use this research to find out where there will be unfulfilled demand from home builders that are growing. We monitor 50 active markets.

Ideal Market Characteristics

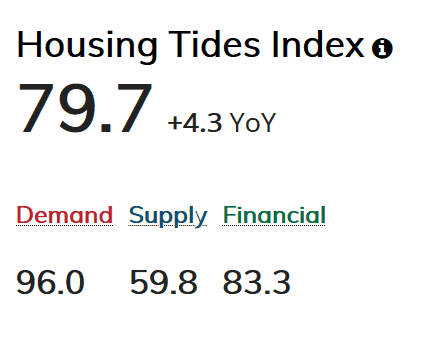

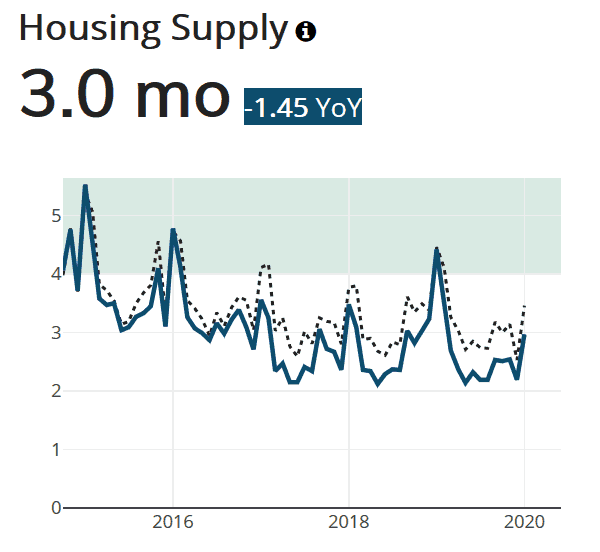

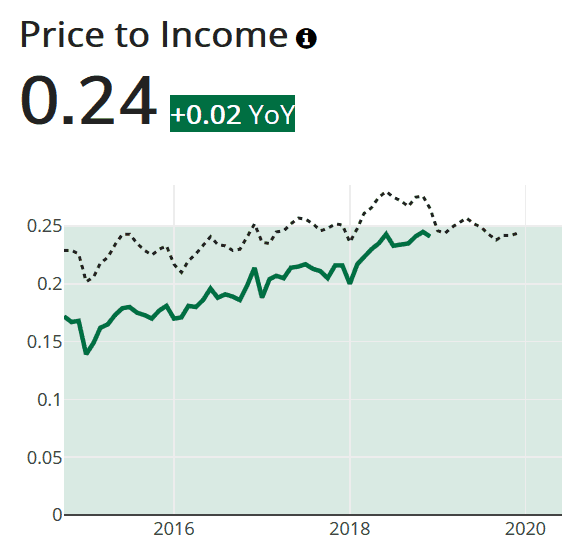

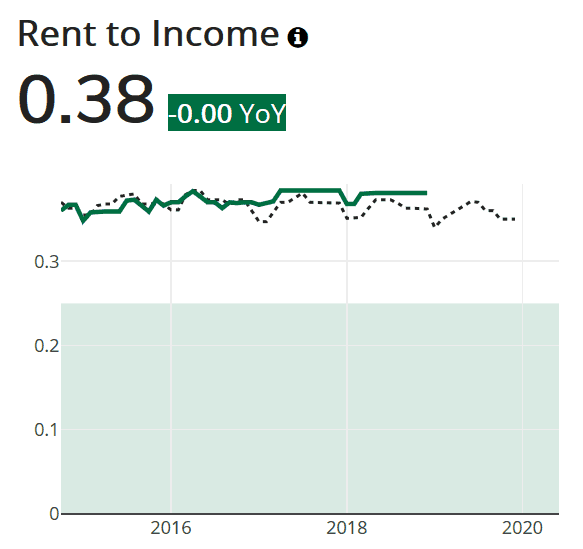

Look for markets with a Housing Tides Indicator of above 80 with a demand indicator above 90 and a supply indicator below 70. Pay particular attention to a Housing Supply Indicator under 3.5 months. The affordability indicators are measure by Price to Income Ratio under 0.25 and rent to income of greater than 0.35. Expensive rent is a leading indicator of future for-sale housing demand.

Tampa and Austin are two markets that we see meeting these conditions.

For example, here are the latest data for the Tampa-St. Petersburg-Clearwater metropolitan area:

Housing Tides Index for Tampa-St. Petersburg-Clearwater metropolitan area - March 2020

"Look for markets with a Housing Tides Indicator of above 80 with a demand indicator above 90 and a supply indicator below 70."

Key: For all charts, the solid line is Tampa and the dashed line is the US average.

Housing Supply for Tampa-St. Petersburg-Clearwater metropolitan area - March 2020.

Solid line = Tampa

Dashed line = US Average, for reference

Price to Income Ratio for Tampa-St. Petersburg-Clearwater metropolitan area - March 2020.

Solid line = Tampa

Dashed line = US Average, for reference

Rent to Income for Tampa-St. Petersburg-Clearwater metropolitan area - March 2020.

Solid line = Tampa

Dashed line = US Average, for reference

Be Ready for Growth After the Storm

As the saying goes, “Out of chaos emerges opportunity”. Prepare for tomorrow’s expansion.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.

One Comment on “Opportunity Emerges Out of Chaos”

Hello Jeff;

Stephen Latham formerly of Latham Brothers Homes and now an inner city builder (Gallup Development LLC) in Denver. We know each other from past business ( LFH and US Homes) in Parker and Littleton in years past. Good to see you are doing well.

Stephen