To open the housing floodgates, all parties must work together to rein in construction costs.

Published April 16, 2020

Affordability Challenges Persist

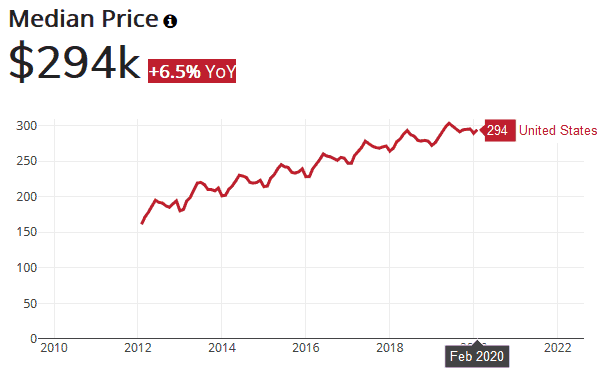

With all the uncertainty brought about by the COVID-19 pandemic, the markets for housing are feeling the impact. Will the bottom fall out of the market as it did in 2008 with housing leading the plunge? How quickly will home building recover? Will home building lead the US out of the recession that is staring us in the face?

Questions that will take time to answer. However, I predict that the following won’t change: the barriers to housing affordability are so entrenched that they will remain even after the pandemic has resided.

Early Market Strength Has Eroded

Builders and homebuyers are now entering an era of uncertainty and putting their plans on hold. Buyers are uncertain about their jobs and incomes. Builders are reticent to build new inventory or start new projects. Supply chains for material and labor are being tested in an environment never seen before.

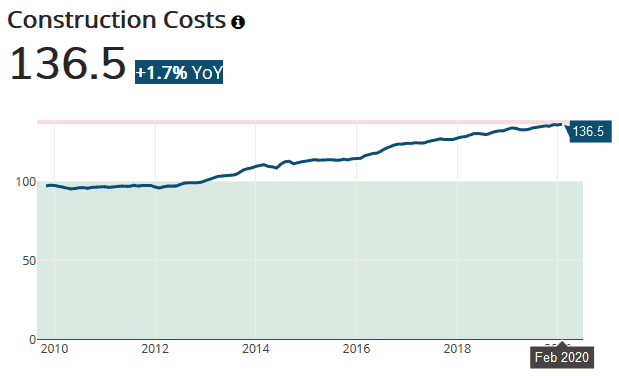

Anecdotally, I am hearing that consumers are looking for deals on homes, yet builders are holding their base prices since costs continue to increase. According to Meyers/Metrostudy, 50% of the home builders in the US are experiencing government service disruptions in inspections and processing.

Research Suggests Minor Pandemic Effects on Home Prices

Zillow reported on March 13 in an article by Svenja Gudell on how past pandemics around the world have had major impacts on the economy but only minimal impacts on housing prices.

The impact of the pandemic only delays the construction of new homes. The affordability issues will not be resolved until local governments remove the barriers to housing project approvals, encourage infrastructure financing through municipal bonds, reduce fees on new communities, reduce permit fees and speed up government services on processing and inspections.

The financial markets have found a way to reduce the cost of a mortgage to an all-time low. Is it too much to ask of our cities and counties to find away to reduce the costs of new home development? Such actions wouldn’t reduce the price of housing for consumers per se but would go a long way to reducing the rate of price increases.

Government Response Can Ease the Burden on Builders

The income to municipal governments generated by fees for building permits and use taxes will dry up in the upcoming months. In 2008 many cities and counties begged the home builders to start more communities and homes so they could avoid laying off personnel and avert budget crises. The time has come again for bold action by local jurisdictions including water and sewer districts.

In Colorado fees for permits, water and sewer taps are running between $50,000 and $60,000. New home building activity would be encouraged by changing the timing of the payment of these fees from application to the time of certificate of occupancy request. This policy change would be a major step in the direction of reducing housing costs. More homes need to be built to meet the housing shortage and put more people back to work after the forced unemployment crisis by COVID-19.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.

One Comment on “Barriers to Housing Affordability Will Remain After the Pandemic”

Hey Jeff:

Good read.. Appreciate the insight. Steve Latham (Latham Brothers business with US Homes years back). Hi to Bryan Daley if you are still connected.