Housing experts weigh in on what we can do next to create a more equitable housing market.

Published July 13, 2020

Nothing Can Be Changed Until it is Faced

We have a responsibility to drive out the structural racism that affects the growth of Black homeownership as well as other people of color. Through antiracist real estate practices, we can and must dramatically improve access to accessible, barrier-free housing for all Americans.

As the great novelist James Baldwin stated “not everything that is faced can be changed, but nothing can be changed until it is faced.”

As an industry, we say that we are fair in our housing practices. Yet another Baldwin quote comes to mind, “I can’t believe what you say, because I see what you do.”

There remains a lot of work to be done to remove barriers to fair housing practices.

The State of Housing in Black America and Other Resources

For detailed background on housing’s role in dismantling systemic racism, I have found some valuable resources well worth reading.

They will educate you to better understand what needs to be done to increase the rate of homeownership among people of color and to provide attainable, affordable, barrier-free housing.

Reading List:

- The Urban Institute provides numerous studies in its Housing Finance Policy Center. You will learn many surprising facts in their research.

- The 2019 State of Housing in Black America is an annual publication by the National Association of Real Estate Brokers (NAREB). Their goal is to bring together the nation’s minority professionals in the real estate industry to promote the meaningful exchange of ideas about our business and how best to serve our clientele.

- The Center for American Progress also has a foundational piece on systemic housing inequality.

- The Brookings Institute weighs in on building Black wealth through homeownership.

-

Also don’t forget to read the editorial by Builder Magazine’s John McManus, “For Home Builders, Black Lives Matter.”

I encourage you to read these materials so you can figure out for yourself “what you can do next.”

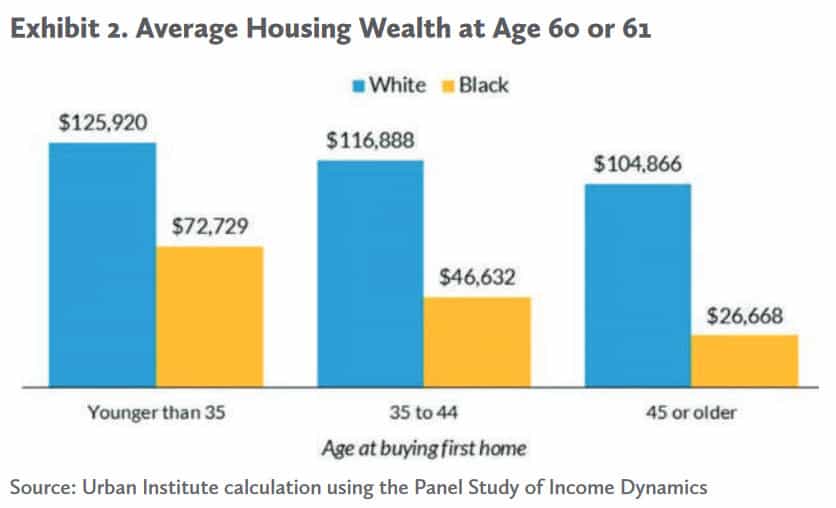

Housing Wealth Disparity Research from NAREB's State of Housing in Black America Report

Why it Matters

Black homeownership has consistently lagged behind that of white families. While the U.S. saw Black homeownership increasing as a percentage into the mid-2000s, that period was followed by the Great Recession, with the rate of Black homeownership dropping by over 4%.

NAREB believes that if Black homeownership had continued at the level of the early 2000s, then there would have been 770,000 additional Black homeowners by 2019. This would have made a substantial impact on gains in Black wealth. Going forward there is currently untapped potential of 1.7 million Black millennials who qualify for homeownership.

Taking a closer look at the 15-year drop in Black homeownership, it appears that the cohort of Black Americans lost the most ground when compared to other racial groups. The Urban Institute notes that the drop in the home ownership rate among married Black households will have ramifications for their retirement prospects as they age.

“Do the best you can until you know better. Then when you know better, do better.” -Maya Angelou

This decline in Black homeownership rates should spark action from everyone in the homebuilding industry as well as government officials at the local level, including planning commissions. Local policies have consistently created roadblocks to Black homeownership with subtle zoning requirements and excessive codes that make affordability out of reach.

After the Great Recession, the financial industry made it tougher for Black home loan applicants to qualify for a mortgage. Increased down payment requirements and tougher credit underwriting structurally undercut the pathway to increasing the Black homeownership rate. This is so obvious now.

As leaders in the homebuilding industry, we have a huge responsibility to fix this and to make the system “bend toward justice” in the words of Martin Luther King Jr.

Let’s do the right thing.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.