What is the yield curve, what does it mean when it’s “inverted,” and why is it important to the residential construction industry?

Aside from coverage of stock market volatility in the last two months, financial media has written volumes dedicated to the shape of the yield curve and what it means for the broader economy. Some have argued that an inversion signals a coming recession, while others assert that it’s merely a small warning that can be misleading in the midst of an otherwise robust, sustained economic expansion. What’s been largely missing from the popular conversation is a discussion of what exactly the effects may be on homebuilding and mortgage lending.

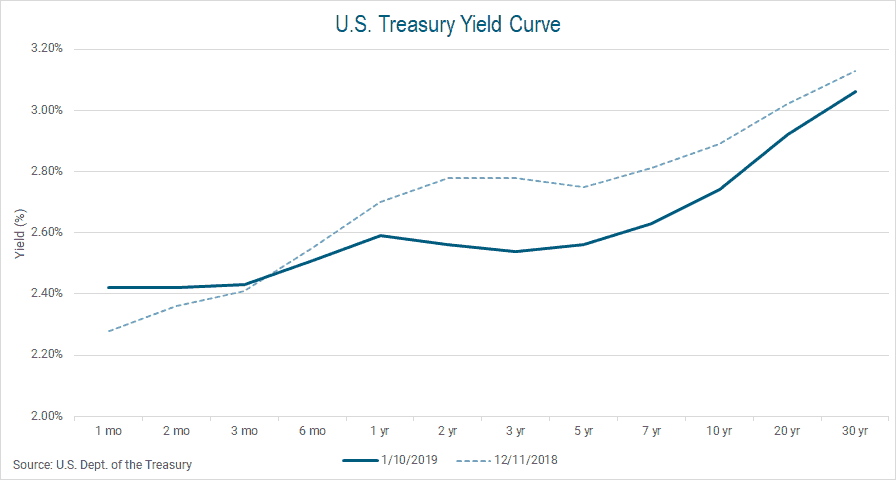

First, a brief explanation of what the yield curve is and what it means when the curve inverts. Basically, the yield curve is the difference in interest rates for bonds of similar risk across different durations. The most commonly-followed yield curve is that of U.S. Treasury bonds, which currently looks like this:

It’s upward-sloping, which make sense intuitively because the borrower should have to pay more to the lender in order to keep borrowed money for longer, as the risk to the lender is greater. In this case, the government (borrower) pays a lower annual rate to borrow for a month than they do to borrow for 30 years. This is called the “term premium.”

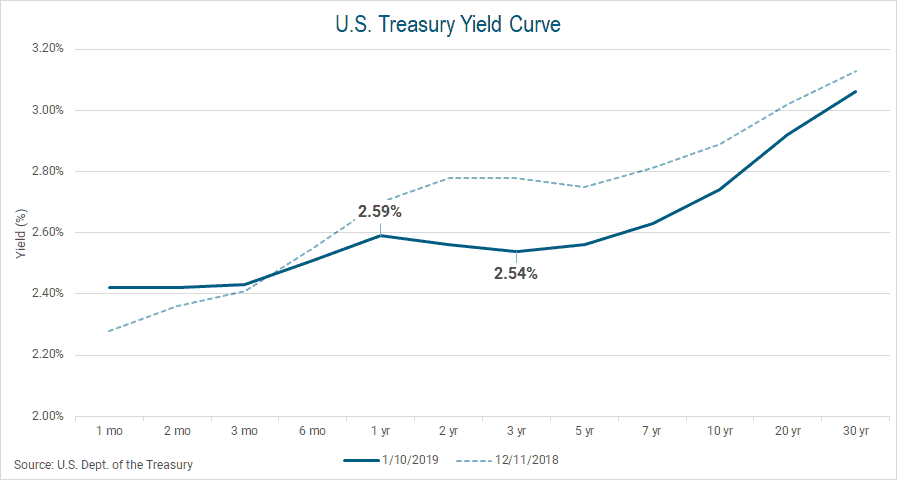

If you look closely, you’ll see that the curve is not upward-sloping throughout. This is the “inversion” that is referred to; specifically, the going rate for 1-year Treasury bonds is currently higher than the rate for 3-year bonds:

A number of things are baked into these rates, including expectations for economic growth, inflation, monetary policy and government spending. Broadly speaking, an inversion is thought to be a signal of a coming recession because it means that investors are betting that growth and investment returns will be higher over the short-term than over a longer period.

For a more detailed discussion of the circumstances determining the current yield curve, see this helpful post from the Brookings Institution. Keep in mind, the current yield curve inversion is modest and has occurred between the 1- and 3-year bond notes only. A steeper inversion, or one that encompassed a wider portion of the yield curve, would be a stronger signal of economic woes to come.

So what does the yield curve inversion mean specifically to the homebuilding and mortgage lending industries? To understand this we

Banks were also asked how their lending policies would potentially change in response to a hypothetical moderate inversion of the yield curve [3-month to 10-year notes] prevailing over the next year. Significant shares of banks indicated that they would tighten their standards or price terms across every major loan category if the yield curve were to invert… Major shares of banks indicated that their bank would interpret this scenario as signaling a less favorable or more uncertain economic outlook and as likely being followed by a deterioration in the quality of their existing loan portfolio. In addition, major shares of banks reported lending would become less profitable and their bank’s risk tolerance would decrease [emphasis added] in this scenario.

This last change is concerning because banks borrow in the short-term and lend in the long-term. For example, banks will “borrow” from balances held in savings accounts (considered short-term assets) and pay the lender a very small interest rate. They then loan these funds for mortgages (long-term) where they can receive a much higher rate. Banks make money on the spread between the interest they pay when borrowing short and the interest they receive when they lend long. Since these rates are primarily driven by the “risk-free” rate – U.S. Treasuries being the benchmark – a steeper yield curve inversion would make mortgage and acquisition, development, and construction lending a losing proposition, and banks would rein in lending activity. That is, they could just buy “risk-free” bonds versus doing more risky mortgage lending.

The effects of a substantial yield curve inversion on homebuilding are less clear. Some builders self-finance and their ability to fund operations would not be contingent on bank lending. Moreover, for-sale housing supply remains tight both in Denver and nationally, with just 1.9 months of supply in the Denver metro area in November. Both the pace of residential construction and the number of delinquent mortgages remain historically low, which support the argument that there is no imminent glut of housing. Absent the risky lending and over-building from the housing boom a decade ago, there needn’t be a big drop in homebuilding volume in order to maintain a balanced market.

On the other hand, inventories are rising (albeit from a low level), sales are starting to fall, and mortgage rates have risen to a level not seen in over seven years. Home price gains have outpaced wage growth for years and it’s likely that

The US Treasury bond yield curve has inverted in one small range, but this does not definitively mean a recession is coming soon. We plan to continue monitoring the yield curve for a more severe