Denver single-family permits are trending down, totaling 1,024 in August and 858 in September.

Recently, news outlets have written that home construction and sales are plunging and crashing, with some arguing that we’re at “peak housing.” We’re not so worried yet. We could be due for some economic pain if the trade fight continues to escalate, and debt is an increasing issue for all parties. In our opinion, there’s been such an unmet demand for housing that there shouldn’t be a huge drop in volume.

There may be some price pain as marginal buyers are discouraged by increasing payments with rates rising, though. Builders will have to get the right product mix, which might mean a continued shift away from large, luxury units, as decreased purchasing power means buyers across the board will likely settle for less house than they otherwise would have sought due to caps on state and local tax deductions, rising mortgage rates and tariffs on imported lumber, steel, and aluminum. Trulia recently noted the mismatch between those seeking entry-level housing and its availability, while the supply of affordable housing has dwindled in places like Colorado Springs and Dallas. NAHB researchshowed new home sizes increased in the first quarter of this year, but floor areas have fallen generally from a peak in 2014.

We like what Bill McBride at Calculated Risk has written about housing markets recently, arguing that existing home sales will be mostly flat over the next few years, but expecting continued increases in new home construction and sales.

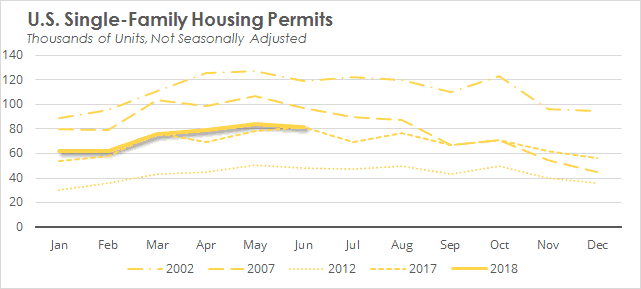

It seems valuable to look at the year-over-year (YoY) change in permits and starts; on a rolling six-month basis, both single- and multi-family are still trending up.

Still, it looks like June was the first time since 2016 that SFD starts were flat YoY, so it’s worth watching:

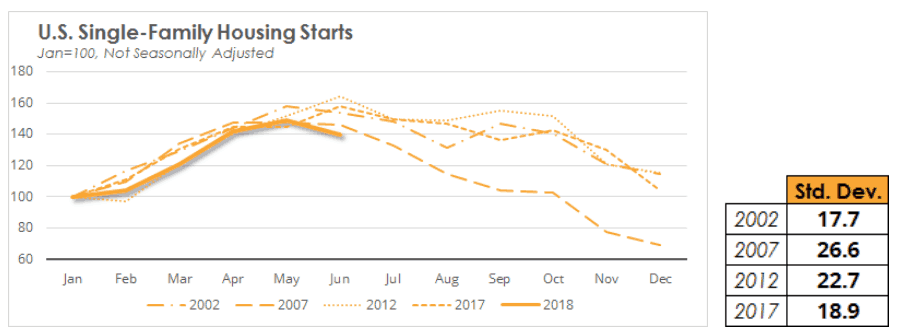

The view is clearer if we set values so that January of each year equals 100:

More consistent volume throughout the year, as is evident by looking at the standard deviation of the indexed series for each year, means that construction in the winter months will look comparatively strong and construction in the summer months will look comparatively weak. In other words, if, say, 75k units in January has in the past been seasonally adjusted to a 1.2M SAAR, and 110k units in June is also adjusted to a 1.2M SAAR, then a smoothing of construction volume across the year could mean we interpret the data as a fantastic January and a terrible June, without adjustments to seasonal adjustment methods.

This last hypothesis needs more exploration, but there’s evidence that homebuilding isn’t crashing yet, particularly when we look at the total number of units under construction. Note, however, that latest Census data for units under construction is from January 2018, so this deserves to be monitored in coming months.