Using Housing Tides data to predict housing market winners and losers in the wake of COVID-19.

Published April 30, 2020

American Resiliency is an Asset

During a routine telephone visit with my doctor, we were discussing the uncertainties that were brought about by the pandemic. We both were concerned about the various fears bandied about in the media. Yet, we both shared a positive outlook for the future. He was excited about the number of vaccines being developed to deter COVID-19. When he asked me where I thought things might be going, I instinctively responded that we are a resourceful people. We will figure much of this out, step by step.

Let us hope that our optimism in our resilience holds true. Our American resiliency is being tested by this contagious killer. Out of the blue, we are shaken to the core. Our social fabric is stretched to a thin membrane. It is important that we do not let our social fabric tear or even dissolve. It holds us together.

The U.S. economy and the housing industry will not escape this pandemic unscathed. As a nation we were already short of housing. This puts us even further behind in closing the gap, especially in the areas of affordable housing and sheltering the homeless. Mortgage loan underwriting requirements have been tightened in April excluding more Americans from the benefits of home ownership.

The money for the stimulus plans that have passed through Congress and been signed by the President and the extra liquidity actions of the Fed have been borrowed from our future. While we owe this money to ourselves, there will be a price to pay for this advance. It is not free. Will we pay for this in inflation and higher taxes? Will the benefits of Social Security and Medicare be trimmed? Will more regulations be layered on us, increasing costs and slowing production? No one really knows what will happen. Our resilience will guide us in the right direction. It is our strength.

Levels of Optimism Vary

Home builders believe in resilience and expect a recovery. The shape of that recovery is the center of much debate and discussion. Some think it will be a swoosh like the Nike® logo. Some think that it will be like a “W” with an intermediate up-and-down before a full recovery is realized.

As America goes back to work, more home buyers will enter the market, driving up demand. Redfin just released an article stating home searches are now exceeding that of the same month in the prior year. Maybe some are looking for bargains, but this leading indicator of the future market shows signs of hope. As people go back to work, the pace of employment growth will determine the strength of the recovery. As of now employment expectations are still fragile and hard to predict. A quick “V” -shaped recovery with housing starts and home-sale listings perking back up is not likely.

Will housing prices stay buoyant? We entered this pandemic underbuilt. There are record low inventories of new homes as well as for-sale listings on the resale market. Prices should stay firm, especially in the markets that were growing before the pandemic hit. Homes in the right locations, with good amenities and schools should hold value very well. For new homes that were not in the best locations, minor incentives such as discounts on options may be needed.

Picking Winners and Losers

Winner - Austin (Jeff Whiton)

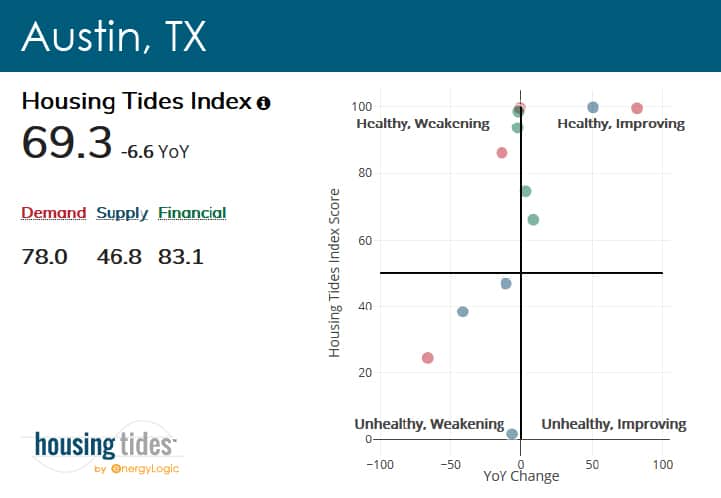

Austin ranks sixth on the Housing Tides Index with a 69.3 (on a scale of 1-100, with 100 being the most healthy). The Texas State Capitol, with one of the largest universities in the country, is positioned well for the quickest rebound. Using the Housing Tides indicators, here is what influences me to pick Austin to perform well in the recovery:

- With the seat of government for one of the largest states, a major university and a burgeoning high-tech economy, Austin has one of the highest rankings in the Housing Tides Index™.

- Austin has enjoyed an extremely low unemployment level at 2.6%. This will bode well as those that have lost their jobs during the pandemic will be able to quickly go back to work, contributing to the recovery with spending and tax revenue.

- Austin remains an affordable housing market. The median home price is $335,000 and it has a price to income ratio of 0.26. This is a major reason why I picked Austin over Seattle and Washington, DC, cities with great economies, yet very expensive housing.

- It appears that housing is under-supplied with only a 1.9 month’s supply of listings and a rental vacancy rate of 4.4%. There will be no overhang of inventory available in the for rent and for sale markets. This will pave the way for increased permit activity during the recovery.

- A housing sentiment review of the 1,936 articles surveyed that mention Austin have an average sentiment of 0.12, which is more positive than the overall article average of -0.04, and sentiment is trending up. Read more about how sentiment is calculated here.

- The Permits to Household Growth Ratio shows that builders are building just 0.9 homes for every household created. The Permits to Employment Growth Ratio is 1.3, meaning that more housing units are being created than jobs, but at this level it is not a major cause for concern.

Winner – Atlanta (Jonathan Scott)

At #2 in our current Housing Tides Index rankings, the Atlanta metro area is poised for strength on the other side of the pending recession. Here is why I expect the Atlanta housing market to recover well:

- Coupling a desirable Sub Belt location with an economy that doesn’t rely on the hard-hit tourism sector, we get a market where housing demand is supported by job growth and household formations. Data suggests that builders in the Atlanta metro area have been building a broadly appropriate number of homes, putting up 0.7 new units per job added and 1.1 per household formed. Consider this jointly with the current for-sale inventory of just 2.6 months of supply, and we have evidence that there is no imminent glut of housing in the Atlanta area.

- Architecture and construction firms have had their expectations flattened across the U.S., but it is clear that businesses operating in the South region believe they will fare better than those in other locales. While still exhibiting steep declines, both the Architecture Billings Index and the Housing Market Index surveys have fallen far less for firms in the U.S. South than, for example, those in the Northeast and Midwest. Of course, we should pay attention to what construction professionals are telling us about their expectations.

- After adjusting for interest rates and local incomes, the monthly payment for a home at the median price of $260k would cost a typical buyer just 22% of their income. This represents a meaningful savings when compared to the monthly payment for a median rental, which would cost a renter 33% of their monthly income. It is also noteworthy that the median home price is well below the limit of $510k set by the FHFA for loans to be eligible for federal backing. We should expect mortgage lenders to have a limited appetite for risk over coming months, and one way in which lenders mitigate that risk is by offloading conforming loans to Fannie and Freddie.

Loser - Houston (Jeff Whiton)

Houston has been faced with the double whammy of fighting the economic impacts of the COVID-19 virus shutdown as well as the largest collapse of the oil market in history. Houston is a metropolitan area built upon the demand for oil. As the oil market falls, so falls Houston. Houston has a Housing Tides index score of 63.8, placing it 23rd on our list of 50 housing markets. Using the Housing Tides data, these factors influence me in picking Houston to be the slowest market to recover from the pandemic.

- The plummeting of the oil industry will only serve to drive Houston’s unemployment level even higher. This high level will continue beyond the recovery from the COVID-19 induced recession. Housings Tides data retrieved from the Bureau of Labor Statistics places Houston’s unemployment rate at 3.9%.

- Houston has a growing housing supply issue. Rental vacancies are running at 10.8% while there is approximately a 3.3 month’s supply of resale listings available in the market. Permits to Household Growth is at 1.7, while Permits to Job Growth ratio is 1.1 indicating an abundance of supply.

- Houston, however, remains an affordable market with a Price to Income Ratio of 0.21. Houston has always enjoyed this positive aspect of housing demand. However, affordability alone is not expected to overcome the expected slow employment growth with the uncertainty in the oil industry.

- A housing sentiment review of 2,506 articles that mention Houston have an average sentiment of 0.04, which is more positive than the overall national article average of -0.04. While the sentiment was trending up just a bit, I would expect that it will deteriorate in the next few months.

Loser - Chicago (Jonathan Scott)

On the other end of the spectrum from Atlanta is the Chicago metro area, sitting at Housing Tides Index rank #35. Here is why I believe the Chicago housing market will fare poorly in the wake of the present turmoil:

- Even before COVID-19 impacts on employment, Chicago-area job growth was tepid at best. With just 175k net jobs added in the last five years, total employment has expanded by only 3.9% -- compare this to metro Atlanta’s 325k net jobs, (+12.8%) over the same period. Combine this with the fact that the Chicago metro experienced a net loss of 21k jobs in the last twelve months and I see a market where home construction is not supported by an influx of potential buyers.

- 56% of Chicago housing units permitted in the last three years were multi-family. It would not surprise me to see a reversal of the last decade’s consumer preference to live near city-centers, as strict stay-at-home orders in major cities remind Americans of the benefits of a detached home with a yard. Additionally, while there was already a trend towards more people working from home offices, the trend has accelerated, and with the rapid growth in business networking tools, some think more of us will work remotely even after corporate offices reopen. The homebuyer at the margin very well may decide that they no longer prefer that apartment downtown.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.