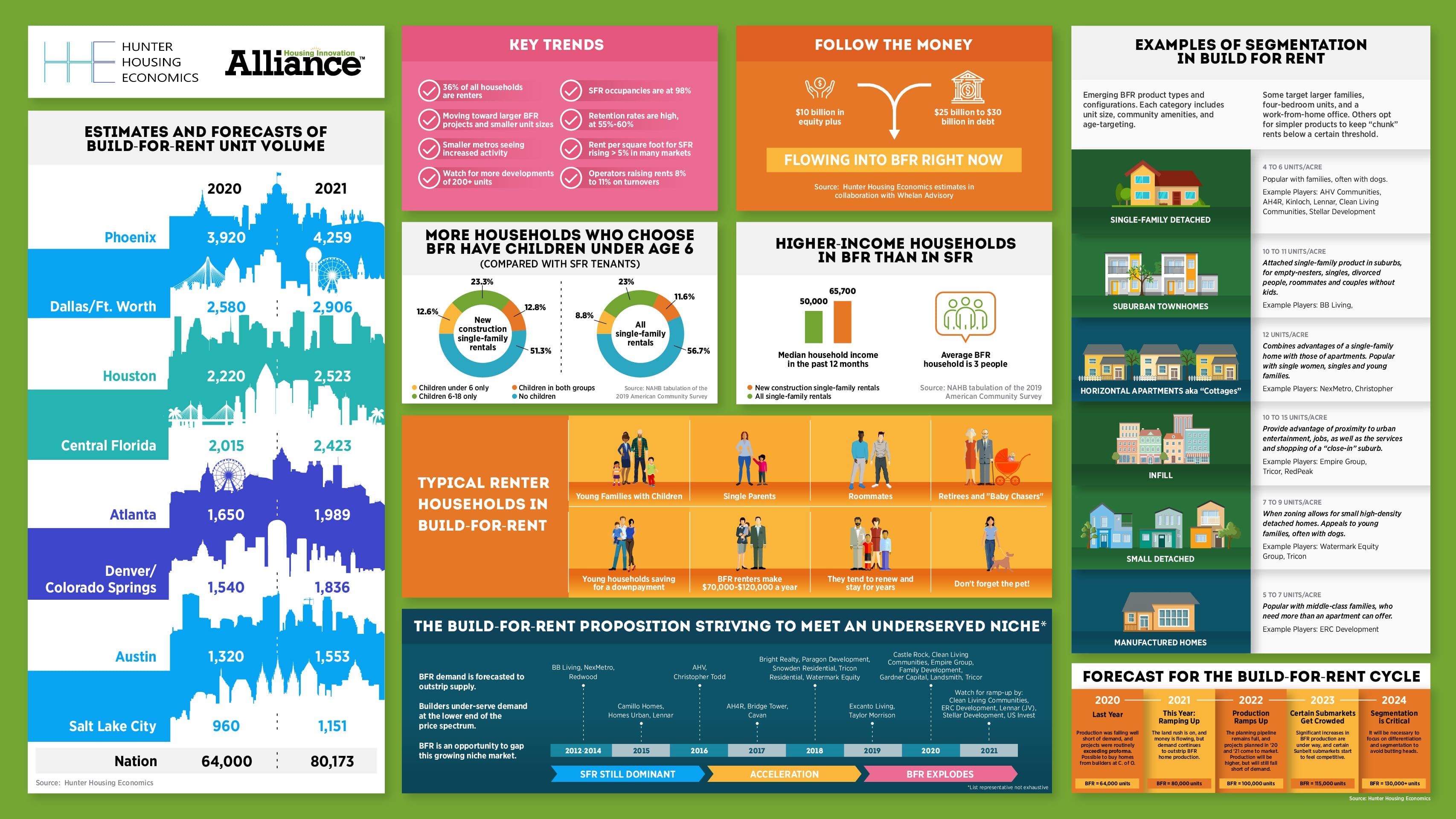

Capital is flowing with generous amounts to the build-to-rent sector of the housing market. Still, demand is expected to outstrip supply.

Published May 28, 2021

Single-Family Rental Market Sizzles and Pops

That July 2019 may have been a record-breaker for heat, the torrid weather's hardly a match right now to the sizzle and pop single-family (SF) build-for-rent (BTR) of residential real estate's hottest trend among investors, developers, and builders. One in 20 new homes comes into being expressly for the purpose of rental living—almost double the historical share of new homes built for rent.

Capital is flowing with generous amounts to this sector of the housing market. Still, demand is expected to outstrip supply as the prospect of renting a house in the suburbs becomes more popular, while rising home prices make buying a new home more elusive.

Millennial Demographic Poised for Significant Growth as Families Grow

A study prepared in 2020 by the Urban Land Institute on family renter housing concluded that

Going forward, families are likely to play an even more important role in the rental housing market. Although the number of families living in the United States remained relatively constant during the past decade, this demographic is poised to experience significant growth in the 2020s and beyond as more and more millennials have children. Similar to these demographic trends, housing preferences are also shifting in a way that is supportive of family-oriented rental development.

Together, declining homeowner rates and rising housing costs are spurring a need for—and a business opportunity to build—new and interesting forms of rental housing that target a broader range of households, including many families."

This report was prepared as a response to the changing growth dynamics of the 2020 decade.

In a January 2021 piece for the Wall Street Journal, Ryan Dezember observes that "investors are building tens of thousands of houses expressly to rent in a bet that Americans will keep flocking to spacious suburban living even if they can’t afford to buy homes."

There are strong reasons why a build-to-rent home offers benefits to nearly every generation and life stage:

- Affordability, BTR homes are more accessible than for-sale housing.

- Millennials are starting families. They need room and want the suburbs.

- For those hesitant to put down roots in a national employment market, BTR offers suitable housing without a long-term commitment.

- Active adults downsizing from larger, owned homes to be closer to family may find renting their next home fits their lifestyle better.

- The expense and hassle of homeowner improvements and repairs are not a worry with BTR homes.

Huge Capital Wave Could Cause an Innovative Revolution

With $40B+ capital to be deployed to this sector and starts expected to double to more than 120k units per year in the next five years, innovation is imperative for build-to-rent. The production processes and financial models behind BTR make it the ideal sandbox to play in and perfect new successful strategies in the early stages of this boom.

Will BTR bring about the increased use of technology in manufactured housing?

Will we see the development of net zero communities, eliminating a substantial portion of housing's carbon footprint?

Will the demand for for-rent single-family homes be sustained?

These are questions many experts in the industry are asking. As the BTR sector emerges, big changes are to be anticipated in the housing market.

Dennis Steigerwalt, President of the Housing Innovation Alliance, asks, "how can we take advantage of this unique moment in time to do some great things that the industry has been looking to do?"

Trends include the Housing Innovation Alliance encouraging its participants to take an enhanced tech approach to single-family build-to-rent. This includes refining from the build-for-sale model to investing in better durability and service. Even though a BTR builder is tied to getting units in the ground with rentals, there is enormous potential for scale and the following economies. The SF BTR model will offer an economic benefit for new applications for modular and manufactured techniques.

This will cut down cycle time and require less labor in a controlled manufacturing environment. Waste and theft can be brought under control. Net zero homes can be built at scale to improve affordability of the latest battery and solar panel technologies.

Key Industry Leaders Show Support for the Growing Build-to-Rent Market Sector

Constuctutopia and Housing Innovation Alliance list many key industry leaders in support of the BTR market:

- Kelli Lawrence, CEO of Onyx + East, states, "we're looking at one of the biggest opportunities in housing."

- Brad Hunter, CEO of Hunter Housing Economics, says, "single-family build for rent (is) creating an affordable product that otherwise doesn't exist in the marketplace."

- Margaret Potter, CEO at Camillo Properties and Camillo Legacy Capital, claims that single-family build to rent is "complimentary instead of a competitor" to build for sale.

- Mitch Rotta, EVP - Acquisition and Sustainability at Tricor LLC in Phoenix, asks if single-family build to rent "is this taking the place of the starter home? It is not a single demographic that's making it."

- Michael Berke, Founder of Tempo Capital Group, states that with build to rent, "capital sees this as the best of both worlds. Funders are becoming more comfortable with the strong renter profiles."

RBC Capital Markets analysts Mike Dahl and Brad Heffern say their rent-versus-buy index—which they calculate as the average monthly rent payment (net of incentives), divided by the monthly mortgage payment on the median single-family home—has recently inflected in favor of rents. They calculate an average reading of 0.98 for the 31 markets they watch, meaning rents are running 2% below mortgages. That's down from a ratio of 1.05 last year and compares with a 10-year average of 1.08. They see the rent-versus-buy ratio falling to 0.93 by year-end.

According to a Forbes article by Michael McMullen, CEO of Prominence Homes, "The build-to-rent sector gathers steam each day and shows no sign of slacking off. But many people misunderstand the inner workings of the market and fail to see what sets it apart. This article will demystify build-to-rent for the average investor. In short, build-to-rent is successful because of concrete math — not flippant fads."

McMullen also cites a CNBC multi-media piece that makes the following key points:

- Demand for single-family rental homes is surging, and homebuilders are now stepping in, redesigning and re-imagining the sector — and becoming landlords themselves.

- "We basically took an apartment and went horizontal instead of vertical," says Mark Wolf, founder, and CEO of AHV Communities.

- "Our business is booming right now with build-to-rent feasibility work," says consultant John Burns.

The Urban Land Institute published a study on Family Rental Housing this year, projecting that demand will outstrip supply in the coming years.

In her December 2020 article "SFR + MF = BTR | How Build-to-Rent Housing is Changing the Residential Landscape," Michele Wood interprets that "they expect that 210,000 units need to be constructed over the next 5 to 10 years to keep up with the demand."

Wood, the Director of Research at Valbridge Property Advisors, has discovered that "this demand is starting to catch the eyes of the investors, as cap rates are the same as multi-family cap rates right now. Rent growth is stronger in the B2R sector than traditional multi-family overall, with 7 to 8% escalations per year in the strongest markets. In the fourth quarter of 2020, cap rates are between 4 and 6.%."

Individuals, family wealth, pension funds and Wall Street's boldfaced names are shoveling billions of dollars into build-to-rent projects. Home builders are embracing the business of selling houses wholesale to landlords, and even teaming up with them to build neighborhoods that blur the line between houses and apartment complexes.'

Our confidence in this opportunity has only increased over the last year,' said Sheryl Palmer, Taylor Morrison's chief executive. Darin Rowe, who runs the home builder's rental business, expects the portion of new U.S. homes that are sold straight to investors to exceed 5% over the next few years, up from the historical average of 1% or so.

Renters Will Pay More for Energy Efficiency and Tech Innovations

Residential renters are willing to pay more for energy-efficient spaces, according to new research.

The research builds on earlier studies, which showed that properties certified green rented for more than non-certified properties. Energy-efficient homes are more likely to hold on to tenants or attract new ones. Tenants, especially the leading edge of the millennials, are looking for energy-efficient properties and are aware of the details such as ENERGY STAR® and the benefits to the environment.

Reducing the carbon footprint is essential for builders, developers, and renters, primarily publicly traded entities. More efficient and sustainable building will also improve a housing project's prospects for gaining entitlements and be a marketing edge to attract today's energy-conscious occupants.

A detailed 2017 study from Iowa State University, "Energy efficiency in U.S. residential rental housing: Adoption rates and impact on rent," researchers concluded that energy efficiency components in rental units were not widespread. Yet, when energy-efficient construction techniques were utilized, rents increased in a range from 6% to 14.1%.

For 118 million residential housing units in the U.S., there is currently a gap between the potential energy savings that can be achieved through the use of existing energy efficiency technologies, and the actual level of energy savings realized, particularly for the 37% of housing units that are considered residential rental properties. Additional quantifiable benefits are needed beyond energy savings to help further motivate residential investors and property owners to invest in energy efficiency upgrades.

This research focuses on assessing the adoption of energy efficient upgrades in U.S. residential housing and the impact on rental prices. Data was collected for over 159,000 rental property listings, their characteristics, and their energy efficiency measures listed in rental housing postings across each city. Over thirty different types energy efficient features were identified. The level of adoption ranged from 5.3% to 21.6%. Efficient lighting and appliances were among the most common, with many features doubling as energy efficient and other desirable aesthetic or comfort improvements

According to the University of Iowa's study, the relative impact on rent charged ranged from a 6% to 14.1% increase in rent for properties with energy-efficient features, demonstrating a positive economic impact of these features, particularly for property owners. Single-family homes generally demanded higher premiums with energy-efficient features.

The results of this work indicate that investment in energy-efficient technologies has quantifiable benefits for rental property owners in the U.S. beyond just energy savings. This methodology and results ultimately encourage further investment and positive economic impact in residential energy efficiency and, in turn, improving energy and resource conservation in the building sector.

Innovation Will Find a Friendly Environment in Build-to-Rent

Brad Hunter, a leading expert in build-to-rent properties, states in his Forbes article that "builders, developers, and investors have a great growth opportunity, but a cookie-cutter approach won't be the winning formula. Careful attention will have to be paid to the specific character of the market and neighborhood in which the homes will be built."

Single-family home rental projects offer a great opportunity for builders, developers, and renters to bring net zero building practices that will impact the environment by minimizing the carbon footprint. Park an electric vehicle in the garage, and life with net-zero carbon usage can become a reality. Renters will reap the benefits of low or no energy costs, and builders can achieve high rents to put into their pro formas.

Summary

- One in 20 new single-family homes built recently is "for rent," not "for sale." Over 80,000 BTR homes are expected to be built in 2021.

- ULI's study on Family Rental Housing this year projected that demand would outstrip supply in the coming years. ULI expects that 210,000 units will be needed to be constructed over the next 5 to 10 years to keep up with the demand.

- Follow the money: over $40 billion is flowing into BTR right now. That's composed of $10 billion in equity and $30 billion in lending commitments.

- Major public home builders D.R. Horton, Lennar, Toll Bros, KB Home and Taylor Morrison, are now operating in this segment.

- A detailed study from researchers at Iowa State University demonstrates that renters are cognizant of and look for "green building" features. Renters will pay up to 14.1% more in rent for these features. This is a great opportunity for a large-scale breakthrough leading toward zero-carbon homes in BTR master-planned communities.

- New opportunities will open for modular and manufactured housing. The standardization of BTR homes is an ideal fit for offsite construction.

- Shifting the paradigm, BTR may become tomorrow's "starter home" as prices have spiraled beyond reach in this hot housing market.

- New technology in homebuilding will be encouraged as scale and standardization will mitigate the extra costs.

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.