An opportunity to root for fixing a broken system.

Published June 12, 2020

Things May Not Be as They Appear

Many residential industry experts are heralding what appears to be a quick recovery of the housing market with traffic to new home developments and sales bouncing back to pre-COVID-19 levels. “Housing will lead us out of the recession” they say. A “V”-shaped housing recovery is at hand. Baloney! A "W”-shaped housing recovery starts with a "V".

Let’s look behind the headlines in the industry media. New homes and the few listings on the resale market are being quickly snapped up by those who have jobs. This is opportunistic buying caused by the liquidity-induced lowest mortgage rates in history.

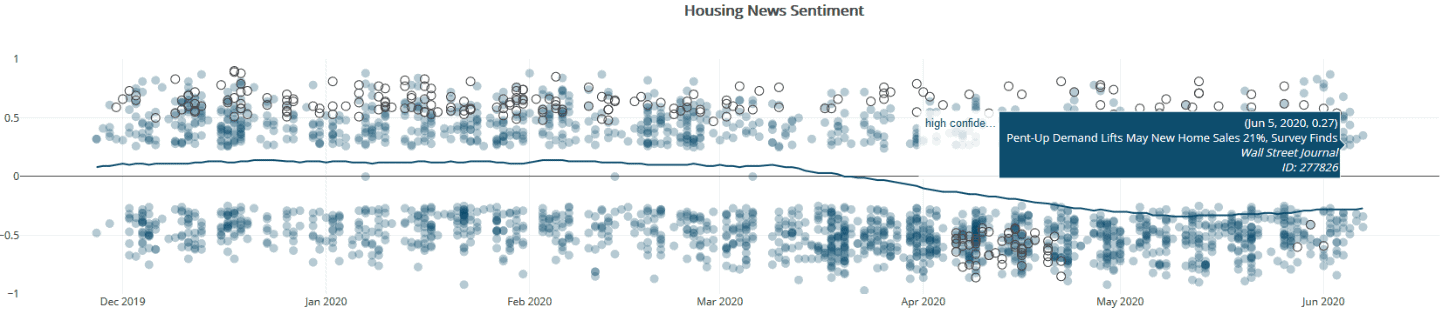

Click to expand image.

Economic Turmoil Impacts Groups Differently

This is not such good news for those that have lost their jobs. They aren’t participating in this buying spree. For the most part these are jobs at the bottom end of the pay scale and at the root of income inequality. These folks are not able to afford decent housing.

For example, African American home ownership peaked at 49.1% in 2004 as compared to 76.2% for non-Hispanic and non-African American. Then home ownership among blacks slid to 41.1% by the end of 2018 (an 8.0% drop) while white home ownership slid to 73.2% (a 4% drop). Remarkably as 2020 began, Black homeownership jumped 2.9% while white homeownership jumped 0.5% according to the Federal Reserve Bank of St. Louis. Increased Black employment and low interest rates provided more opportunity for these households. What can we do to continue to accelerate such improvements in wealth-building through home ownership and better paying job opportunities?

Beware of Rooting for an Unjust Status Quo

This is not the time to cheer on, or expect, a “V”-shaped recovery. Remember that a "W”-shaped housing recovery starts with a "V". This is a time to solve the structural problems of housing affordability, housing availability and eliminate intended and unintended racist structures that still dog our nation. This is the first in a series of blogs where we will explore these issues.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.