It’s imperative that while we collectively hope for and work towards the best outcomes, we also prepare for the worst.

Published April 6, 2020

Outline

This piece is packed with strategies and insight that will help you develop strong, resilient business strategies to navigate Colorado's COVID-19 housing market.

Here's what we cover:

- Lessons from the Experts: How to Look Ahead

- Lessons from Decisive

- Lessons from Superforecasters

- Housing Market Positives

- Low interest rates

- Housing under-built in recent years

- No sign of excess rental housing

- Housing Market Negatives

- Consumer & builder sentiment

- Unemployment

- Decreased traffic for new build/existing re-sale

- Three Potential Scenarios

- Business as usual

- Moderate deterioration

- Worst-case

How to Look Ahead

Plan to be Wrong / Lessons from Decisive

The first dog-eared book in our library of resources for a time like this is Decisive: How to Make Better Choices in Life and Work by Chip and Dan Heath. In the book the authors propose the “WRAP” process as a means to make superior decisions, given our natural tendencies toward mental biases and irrational thinking:

-

- Widen your options

- “Narrow framing leads us to overlook options… We need to uncover new options and, when possible, consider them simultaneously through multitracking.”

- Reality-test your assumptions

- “To combat [the bias to collect self-serving information], we can ask disconfirming questions.”

- Attain distance before deciding

- “Short-term emotion tempts us to make choices that are bad in the long term.”

- Prepare to be wrong

- “We are overconfident, thinking we know how the future will unfold when we really don’t. We should prepare for bad outcomes (premortem) as well as good ones (preparade).”

- Widen your options

Lessons from Superforecasters

Another resource we’re reaching to right now is Superforecasting: The Art and Science of Prediction by Philip E. Tetlock and Dan Gardner. Tetlock and Gardner refer to the Good Judgment Project – a massive, crowd-sourced set of projections on hundreds of topics made by a variety of participants, both expert and amateur – to glean behaviors and best practices used by the very best forecasters that we can leverage to improve our own predictions. In this book and other recent publications by Tetlock and colleagues, essential characteristics of forecasters who outperform their peers include:

-

- Humility/open-mindedness

- The best forecasters acknowledge their own fallibility. Rather than making up their mind once and sticking to it, their predictions are iterative, regularly making small adjustments to the previous outlook.

- Curiosity/desire for more data

- Successful forecasters are voracious consumers of information and actively seek out resources that challenge their conclusions and worldview. Mediocre forecasters tend more towards materials that validate their current beliefs.

- Probabilistic mindset

- Rather than arriving at an iron-clad conclusion that X will happen, superforecasters employ probabilistic thinking – the idea that a variety of outcomes are possible given the current state of the world. By being more concrete in our assignment of probabilities (e.g., there’s a 50% chance of X, a 30% chance of Y, and a 20% chance of Z), we’ll be better prepared than if we plan just for X.

- Humility/open-mindedness

If you’ve paid close attention, you’ve noticed that there’s meaningful overlap in what we can learn from these experts: be humble and open to new information, and prepare for different possible futures. How can we translate these lessons to our outlook for the Colorado housing market? Let’s examine what the latest data is telling us.

Housing Market Positives

First, there are some positives going for us...

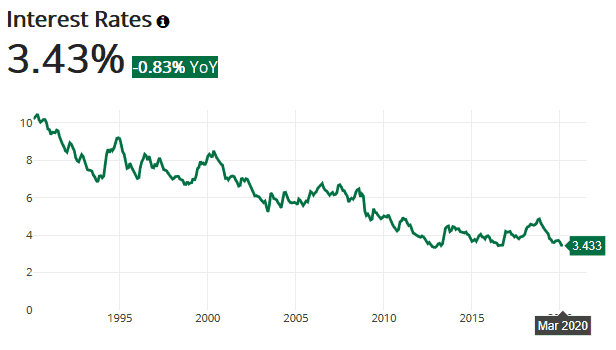

Low Interest Rates

After moves to raise interest rates over the last several years, the Federal Reserve has reversed course and lowered the inter-bank lending rate to the 0.00-0.25% range. Mortgage lenders have exhibited caution by not dropping prevailing mortgage rates in tandem with the Fed, as lending in a recessionary environment is risky, but mortgage rates remain near the lowest level we’ve ever seen. The tremendous injection of liquidity provided by the Fed in recent weeks should support the financial system and mortgage lending, which is a positive signal for sustaining purchase financing throughout this crisis.

Click image to expand.

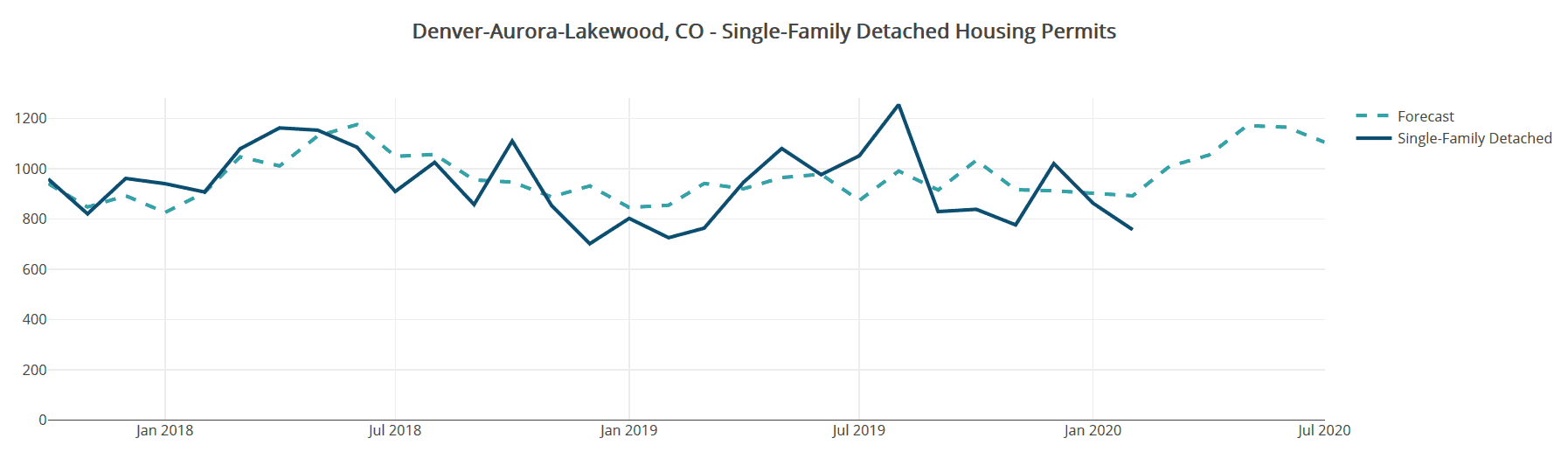

Low Housing Inventory

Unlike the Great Recession, we enter this period having under-built housing in most places. Denver homebuilders received permits for 1,740 homes per month between 1995-2004; 1,330 permits were filed per month for the most recent ten-year period, despite a larger and quickly-growing population. Per Redfin data, the Denver metro had under 4,600 homes for sale in February, good for just 1.3 months of supply at the current sales pace. To be sure, home sales will slow as potential buyers rein in spending and are encouraged to stay home, but Denver remains a desirable place to move to and there is no over-supply of housing.

Click image to expand.

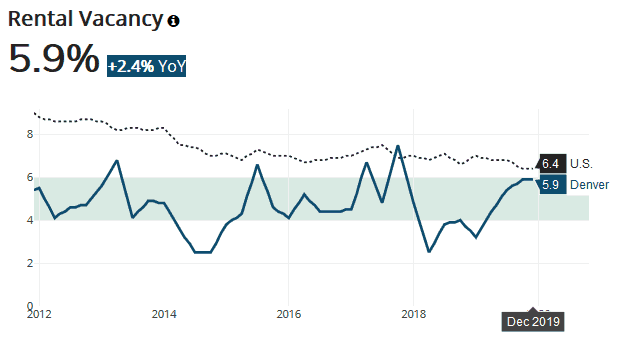

Low Rental Vacancy

Supporting the previous point, there is a balanced supply of available rental properties in the Denver market. If there were a large number of empty rentals available then we’d expect a pivot from for-sale housing into rentals given the economic uncertainty that we’re facing, but there is no such abundance of rentals to be had.

Click image to expand.

Housing Market Negatives

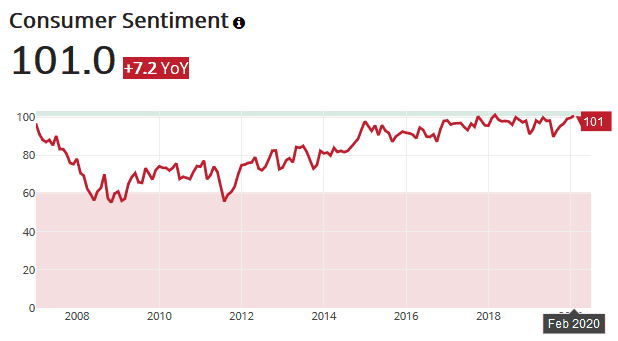

Deteriorating Sentiment

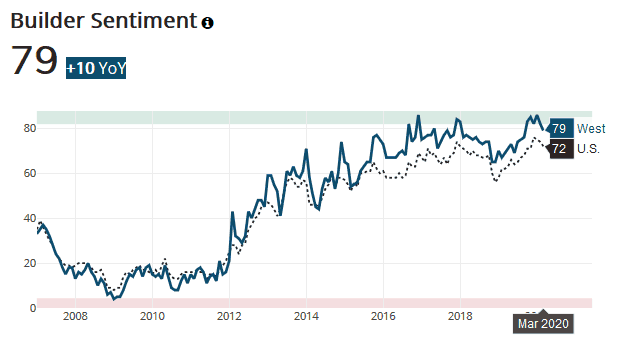

Consumer and homebuilder sentiment are lagging indicators, meaning that we only get measurements after-the-fact. Current readings show the University of Michigan consumer sentiment falling 12% month-over-month to 89.1 in March and homebuilder sentiment holding at a high level, but early readings and comparisons with past economic shocks suggest that the outlook of market participants is likely to significantly worsen in coming weeks. The University of Michigan survey results show the seven-day moving average falling further, to a level near 70 at the end of March. We can expect homebuilder expectations to follow as their success is predicated on the health of consumers.

Click image to expand.

Click image to expand.

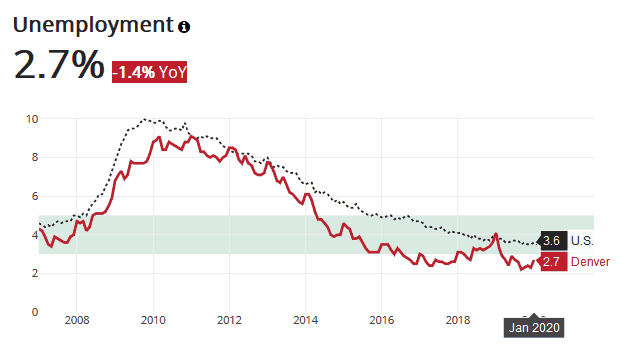

Rising Unemployment

Denver has enjoyed very low unemployment in recent years, with the latest reading from the Bureau of Labor Statistics estimating unemployment at just 2.7%.

Estimates vary widely, but one projection from St. Louis Federal Reserve economists is for a peak unemployment rate of 32%.

Click image to expand.

Fall in Prospective Home Buyer Traffic

Recent presentations from Metrostudy/Meyers Research suggest that “70% of builders saw on-site traffic decrease by 20%+ week-over-week” as home shoppers sequester themselves at home under the direction of officials at all levels of government.

Clearly homebuilders can offset some of this on-site traffic with an increased online presence, but the uncertainty associated with the coronavirus crisis does not engender the confidence required to commit to a large purchase like a new home.

Potential Scenarios

Scenario One:

Base Case - "Business-as-usual" [Unlikely]

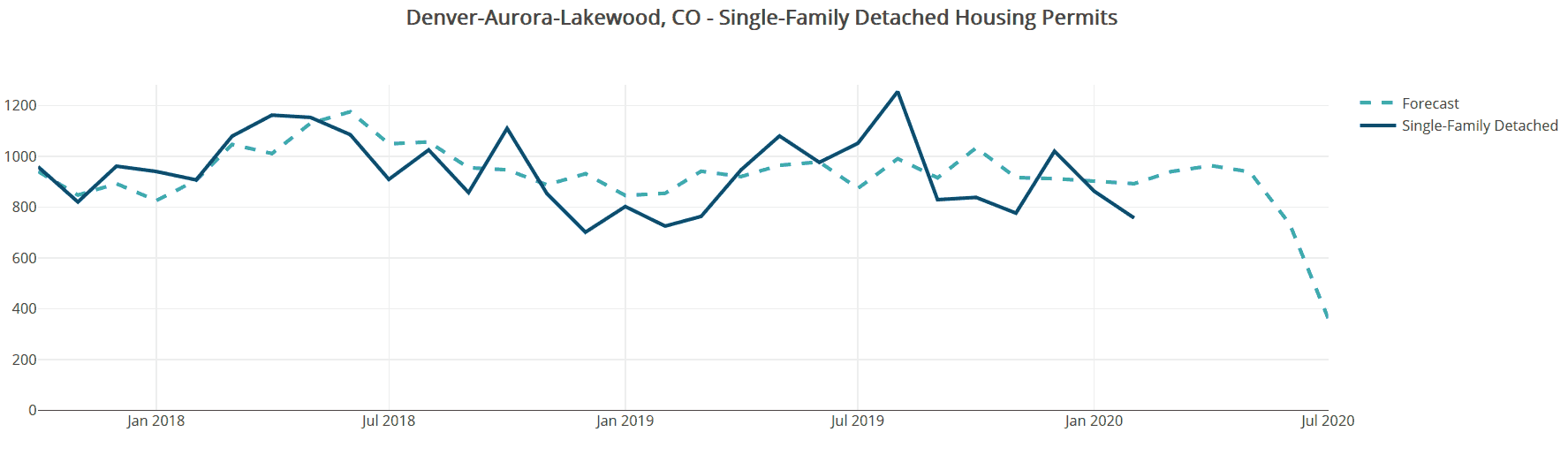

Our base case, business-as-usual forecast, grounded in most-recent data releases suggests Denver metro housing permits will rise in coming months, reaching a rate of 1,200 single-family per month in May-June. However, we must reiterate that these projections are dependent on lagging indicators and it is unlikely that this scenario will come to pass. Instead, we expect to meaningfully revise these forecasts in coming weeks as new data is released detailing the extent of the economic slowdown.

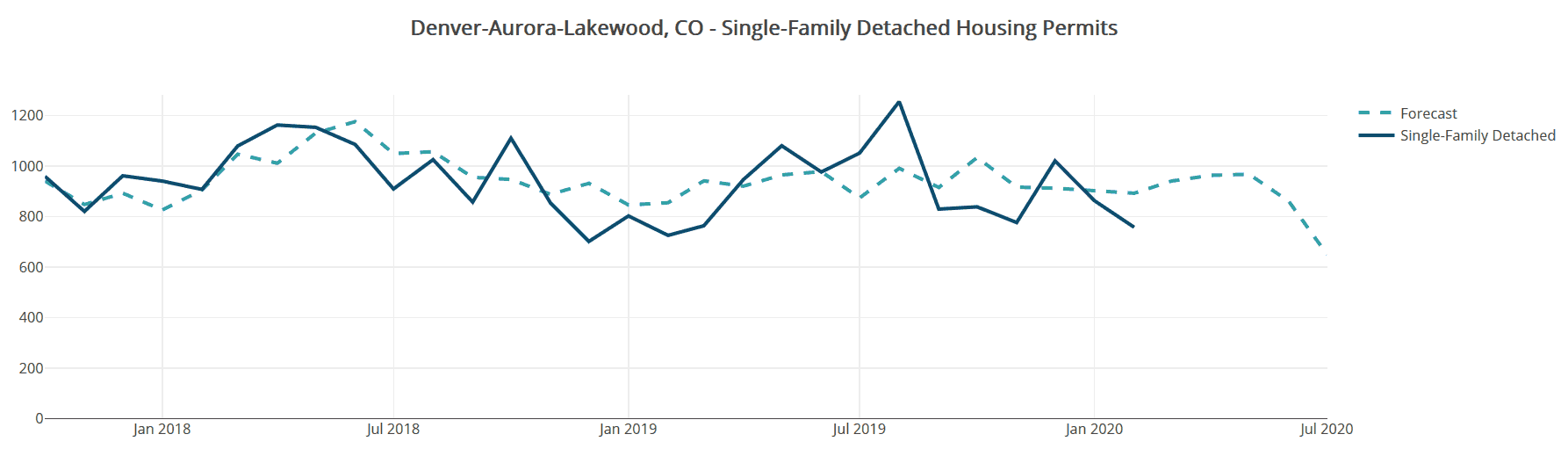

Scenario Two:

Moderate U.S. Housing Market Deterioration

Drawing from the concepts from Decisive and Superforecasting we referenced above, we ought to envision some alternative scenarios so as to prepare our organizations for other potential outcomes. One such scenario is a moderate slowdown for Denver housing and associated sectors. This entails a meaningful rise in unemployment with related hits to market confidence and a drop in lending activity, but not a worst-case scenario. In this scenario we’d see an initial flattening of permit activity with a subsequent bottom of 650 permits reached in July.

Scenario Three:

Pronounced Recession

Closer to a worst-case scenario would be a recession more like the Great Recession, with a larger increase in unemployment, a quick 10% drop in home prices, and bigger declines in lending activity and market confidence. Zillow research on the SARS and other flu outbreaks finds that real estate prices were little affected by pandemic events, although the crises studied did not result in GDP declines on the same scale as those predicted by current U.S. forecasts.

If this type of economic distress came to be, we’d expect a steeper drop in permit activity, falling to a total of just 360 permits in July.

We Hope this Information Helps You Navigate these Uncharted Waters

Fear of the unknown is dominating the media, political discourse and planning efforts of organizations around the world right now, and this exercise isn’t meant to stoke those fears. Rather, it’s imperative that while we collectively hope for and work towards the best outcomes, we also prepare for the worst. Learning from experts that have devoted their careers to planning in uncertain circumstances has proven to be beneficial to EnergyLogic and the Housing Tides team, and we hope you find this work useful too. All the best to you and your families, friends and colleagues, and we’ll look forward to working with our valued business partners in the year to come, whatever that year brings us.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!