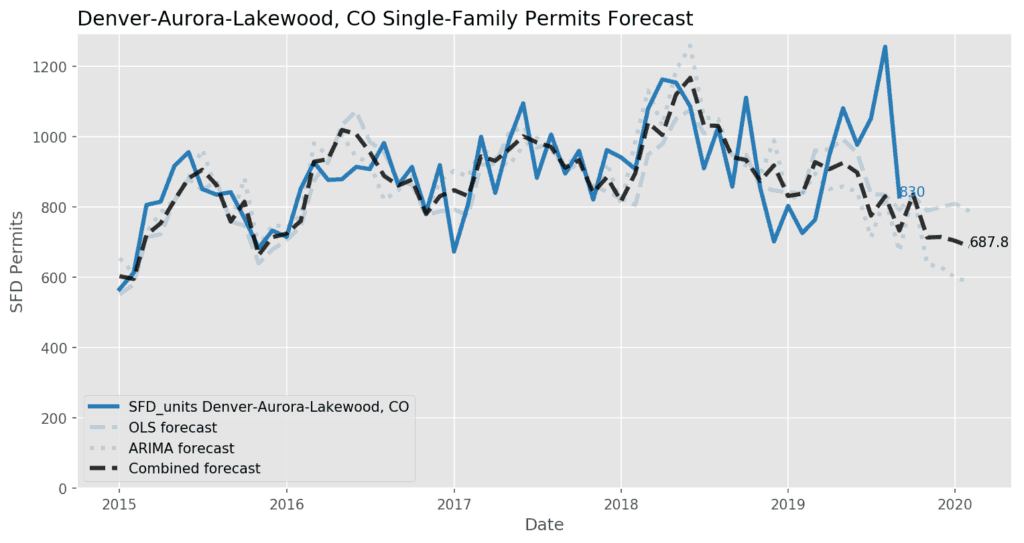

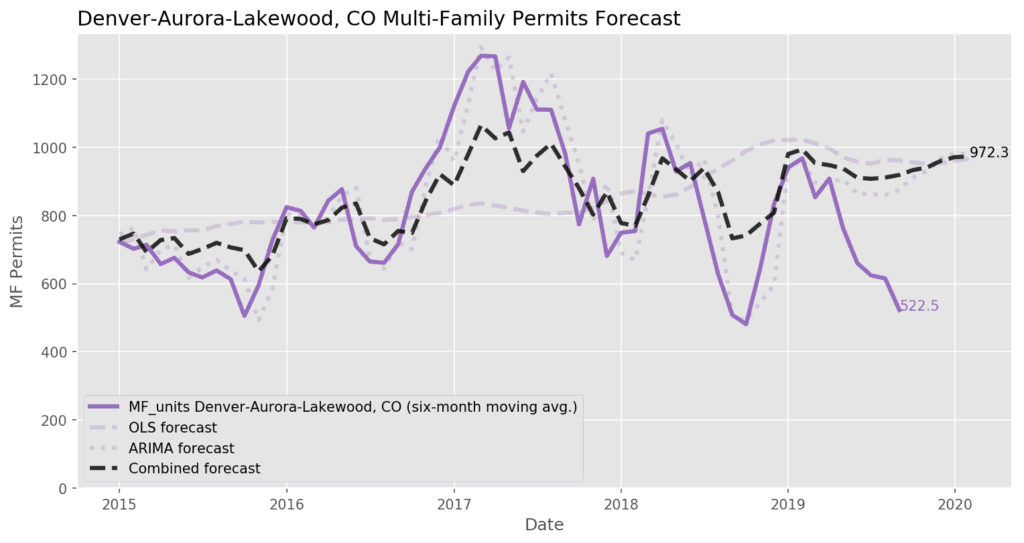

Single and multi-family construction permit activity diverge in recent months. Lower mortgage rates reinforce builder confidence, but consumers say it's not a good time to buy a home and remain wary of a recession in 2020.

Mixed Results in August and September

Renters Get More Options

The multi-family slowdown may be attributed in part to increased availability of rental units in the metro area. The U.S. Census estimates that Denver rental vacancy rose from 2.5% in 2018 Q2 to 5.4% in 2019 Q3, and savvy multi-family developers are surely wary of committing to too many projects and oversupplying the market.1 Still, we’d be wise to monitor rental vacancy in conjunction with measures of supply of for-sale units; Redfin reports that for-sale inventory constitutes just 1.8 months of supply at the current sales pace, suggesting that housing demand continues to exceed supply. This will support multi-family absorption for the foreseeable future, especially if annual rent appreciation slows from the robust 7.5% rise observed in September.

Construction and Job Growth in Harmony

The slowing pace of Denver-area homebuilders may prove to be prescient in hindsight, as the timing coincides with a general slowing of Denver job market growth as well. The metro area added just 24k jobs in the last year, down from a peak of 41k in early 2018.2 Builders have filed plans to construct 0.8 homes per job added in the area in the last twelve months, a level which is broadly understood to support a sustainable market balanced between homebuyers and sellers. This ratio dipped as low as 0.25 – meaning the metro was adding four jobs per new home built – in recent years, and it’s encouraging to note that builders appear to have their plans well-calibrated to the current level of demand.

Builder Outlook Strengthened by Cheaper Loans

Furthermore, builders tell us that they’re confident in their prospects, with the NAHB Housing Market Index survey continuing to rise swiftly after tumbling throughout 2018. Homebuilders are as confident about current and future sales as they’ve been since late 2005. Homebuilders in the U.S. West region are among the most optimistic, which is corroborated by renewed growth in the volume of work reported by West region architecture firms.3 Survey participants surely see their outlook bolstered by the recent fall in mortgage interest rates, which, currently at 3.75%, are a full percentage point lower than one year ago. They may fall further still.4

Consumers Eyeing Recession?

While consumers remain solidly positive in their assessment of current economic conditions, they’ve expressed greater concern about how they’ll fare in the months ahead.5 While refinance and home purchase activity has surged with the drop in interest rates, surveyed consumers noted that the conditions for purchasing a home are as poor as they’ve been in over 10 years.6 The consumer’s sizable contribution to U.S. economic activity means that we should closely follow the aggregate consumer outlook; decisions to delay or cancel big-ticket purchases can have broader ripple effects.

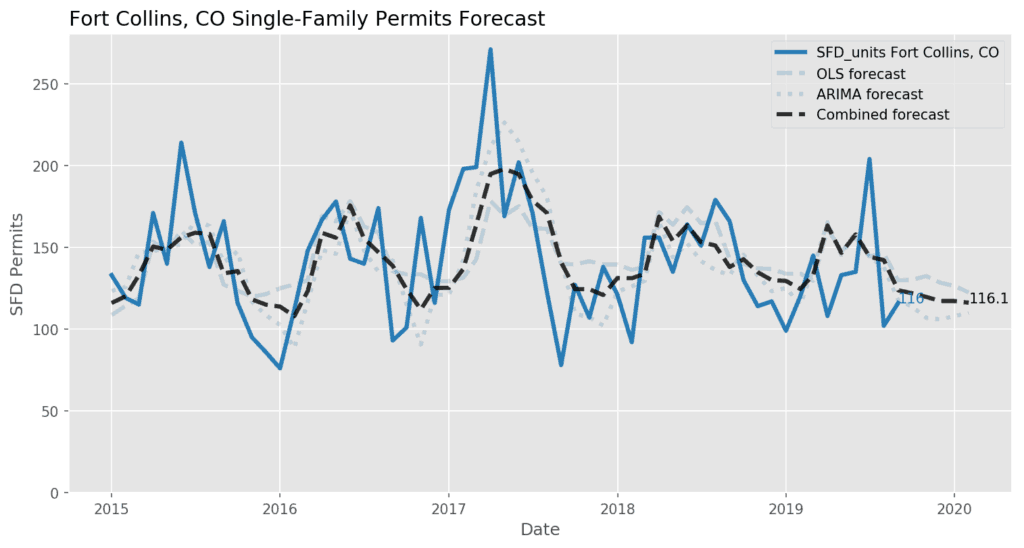

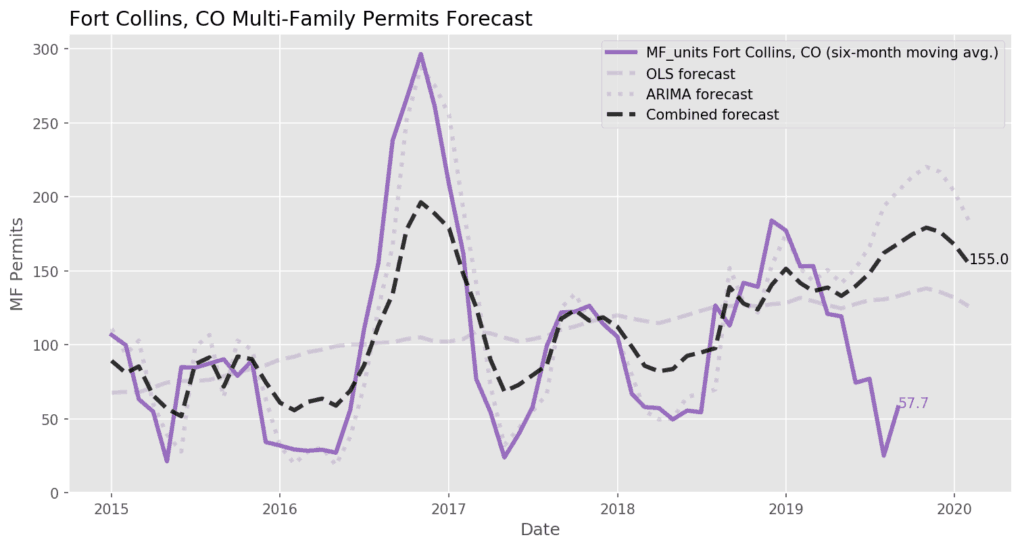

Looking Ahead

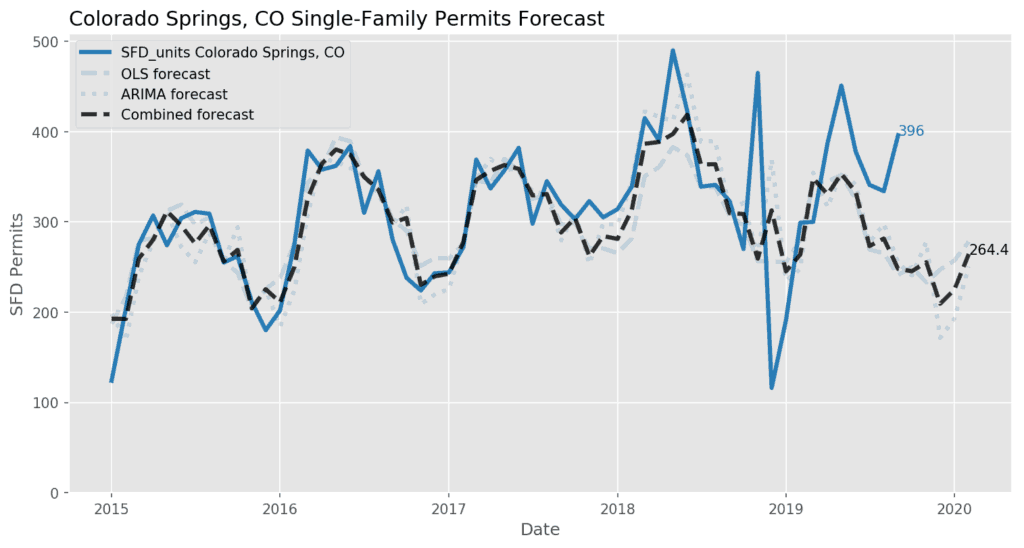

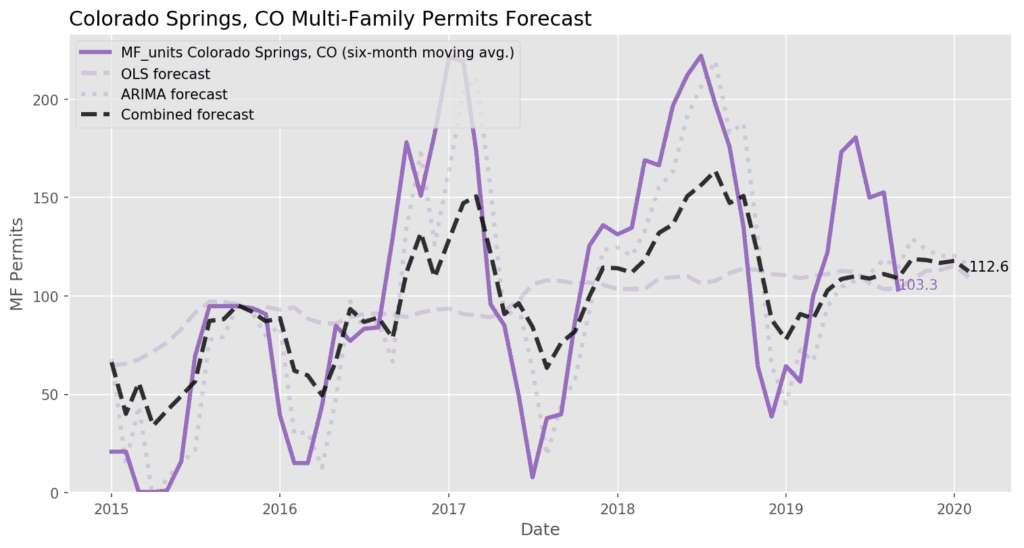

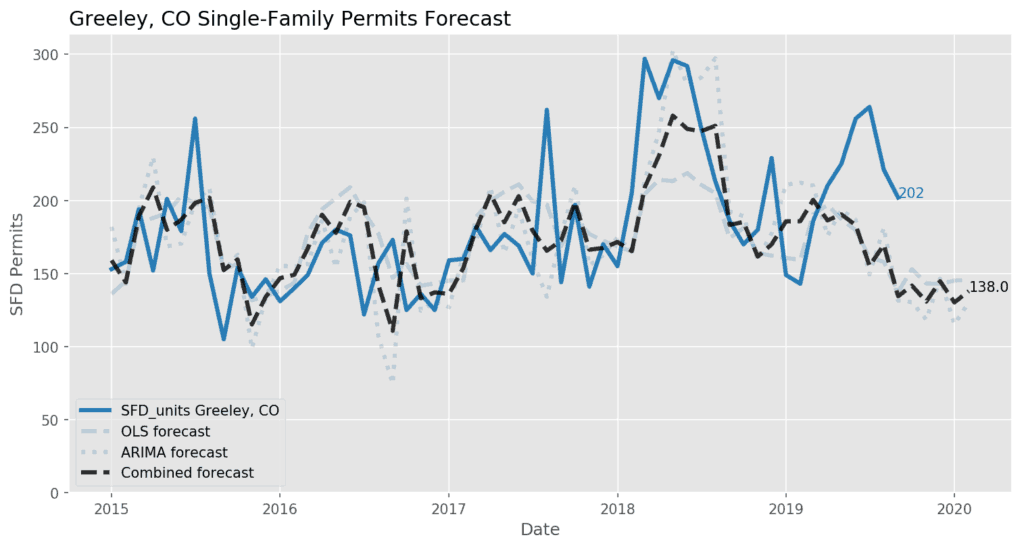

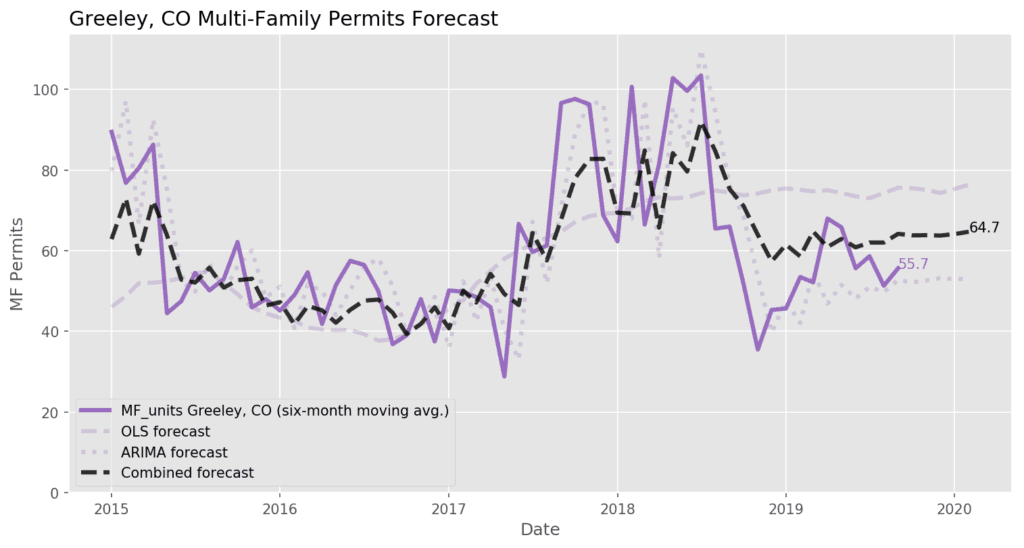

Market Indicators and Permit Forecasts for Colorado Markets

(Click to expand sections and see charts)

Not familiar with some of the terms below? Jump down to our economic data definitions.

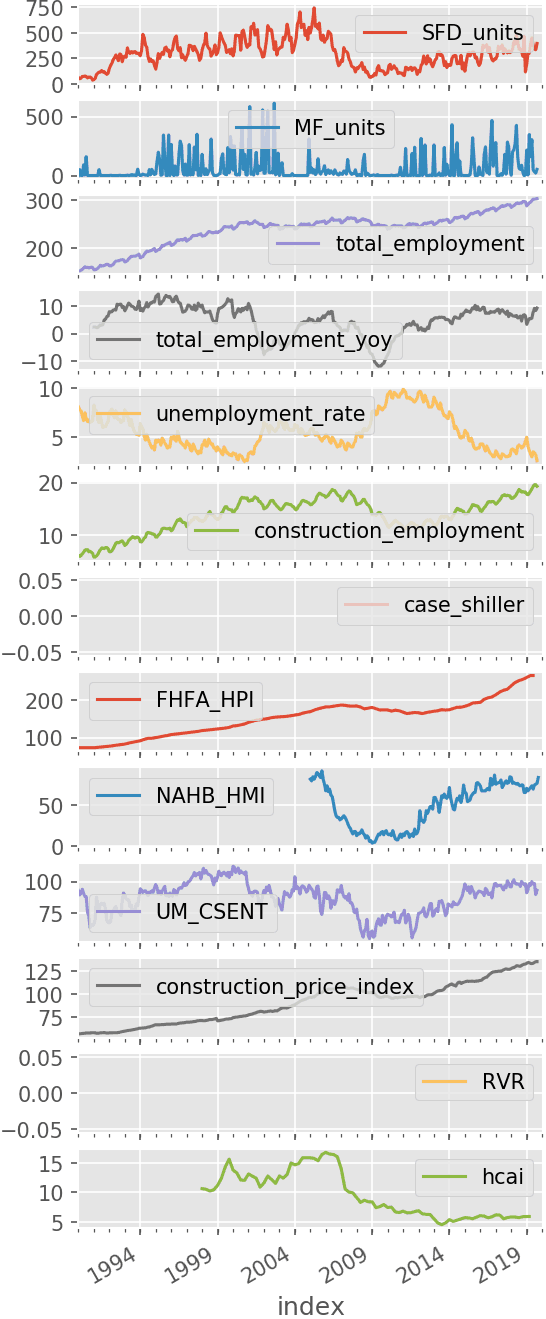

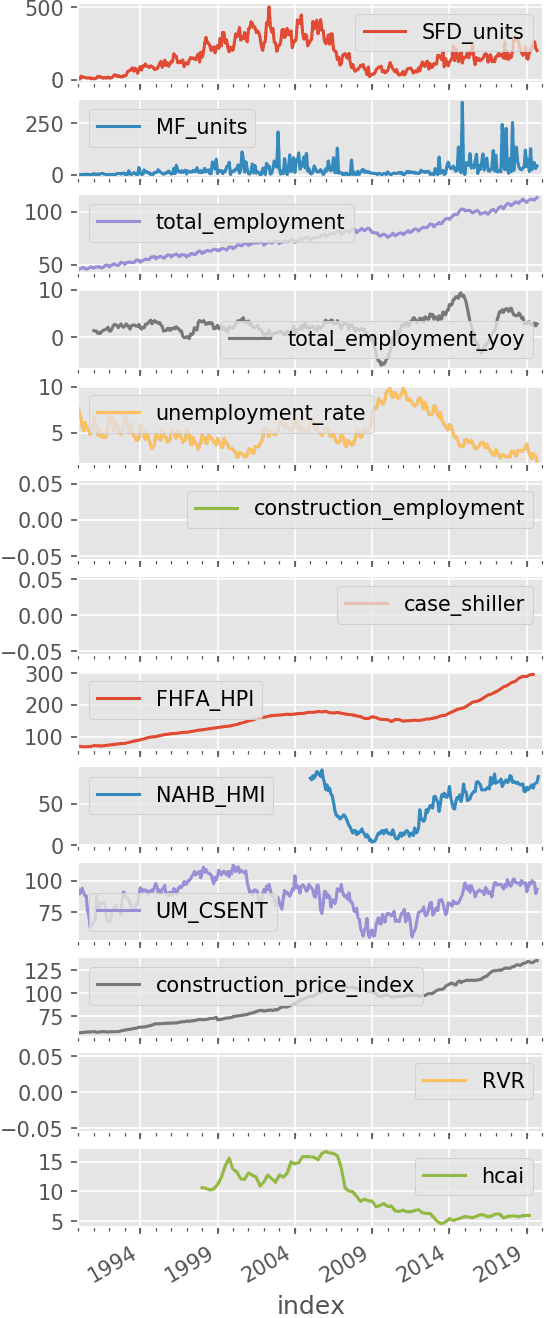

Economic Data Definitions

Economic Data Definitions

SFD units

2to4 units

MF units

total employment

total employment yoy

unemployment rate

construction employment

case shiller

FHFA HPI

NAHB HMI

UM CSENT

construction price index

RVR

hcai

Sources

- https://www.census.gov/

housing/hvs/index.html - https://fred.stlouisfed.org/

series/DENV708NAN - https://www.aia.org/

pages/6220566-abi-september-2019-firm-billings-remain-sl - https://www.cnbc.com/

2019/10/30/fed-decision-interest-rates-cut.html - https://blogs.wsj.com/

dailyshot/2019/10/30/the-daily-shot-latest-curve-inversion-has-been-shorter-and-shallower-than-previous-ones/ - http://www.sca.isr.umich.edu/

files/featured-chart.pdf