Fresh housing data suggest obstacles and waypoints toward market recovery.

Published June 4, 2020

Examining Market Conditions

Housing Tides recently updated its housing data with the most recent information marking May’s month end. There is much to digest once you log on and search for your markets of interest. As I have predicted the recovery in housing will follow an uncertain “rocky bottom” more or less in the shape of a “W”. This month’s review of the economic indicators affecting housing show some positive signs of recovery while some new risks have been introduced into the market.

What Are the Encouraging Signs of the Housing Recovery?

- One of the most encouraging signs of the recovery is that the applications for purchase money mortgages are now above 2019 levels.

- Housing Tides internal review of quick move-in inventory of new homes in Colorado, which had been increasing through April, reversed course in late May, and are down considerably when compared to inventory from summer 2019. This is a survey of a subset of major homebuilders. Buyers are flocking to quick move-ins, well-aware that mortgage interest rates reached an all-time low of 3.15% at the end of May.

- The Wall Street Journal reported on May 30 that the spread of the remote-work culture could spark a housing boom in the suburbs and smaller cities.

- With the stock market rebound with the S&P 500 now over 3000, the wealth effect comes back into play for consumer confidence. This could translate to increased housing demand boosted by low interest rates.

- Housing is becoming a scarce commodity. Resale listings have reached new lows in many markets. Homebuilders have not been able to supply the demand for housing in at least have of the states for the past five years. Redfin reports that the Denver market had just 1.8 months of supply listed for sale in April. Consequently, despite the economic blows of the pandemic, housing prices are buoyant and are increasing in some markets. The same Redfin data show median home sales prices up 4.8% year-over-year in April.

- Homebuilders have taken note of the potential for a quick recovery, with the NAHB Housing Market Index rebounding from 30 in April to 37 in May. The West region fared even better, rising from 32 in April to 44 in May.

What Can Hold the Housing Market Back? The Specter of New Risks

While the encouraging signs listed above lead some industry observers to believe that there will be a “V” shaped recovery or even a smooth, longer-term swoosh recovery, new risks have been introduced into the marketplace. And, the risks of the pandemic will not go away quickly. This is why I believe the recovery will be a rocky one. There will be false hopes dashed by some new realities that cycle through several times before a full recovery. In managing your business activities plan for future disruptions from what is known and from what is unforeseen.

- The manifestations from the pressure cooker of social issues are boiling over. Assume that there will be effects that will show up in unique ways to disrupt your plans. The consequences of the recent riots and protests were unforeseen. In this environment more unforeseen Black Swan events could develop overnight.

- China may push its belligerence further into Hong Kong, Taiwan or even India. This will cause tensions to rise that affects all products that we use that are manufactured in China. A new Cold War would have pervasive consequences on the equities markets and the supply chain.

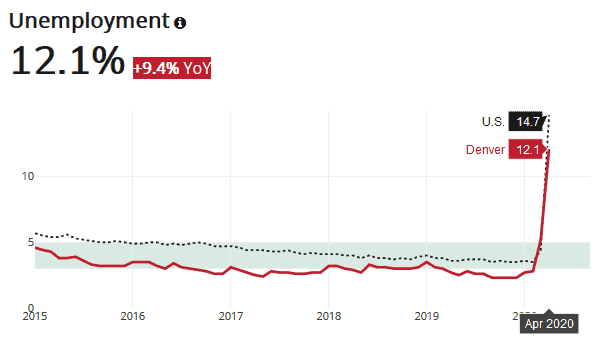

- If employment numbers don’t improve to meet recovery expectations, the equities markets could fall, wiping away confidence and wealth and setting the recovery back from interim highs. The Bureau of Labor Statistics just reported the Denver metro unemployment rate hit 12.1% in April, considerably higher than the 9.1% rate reached in March 2010, but lower than the U.S. overall rate of 14.7% in April. Contrast this with a rate of 33.5% in Las Vegas. With the inherent delays in the BLS metro-level data releases we should look to the weekly unemployment claims reports for more timely clues. We’re looking for the weekly numbers to stay under 2 million claims, which came to fruition with 88M new unemployment claims filed for the week ending 5/30/20.

Click to expand image.

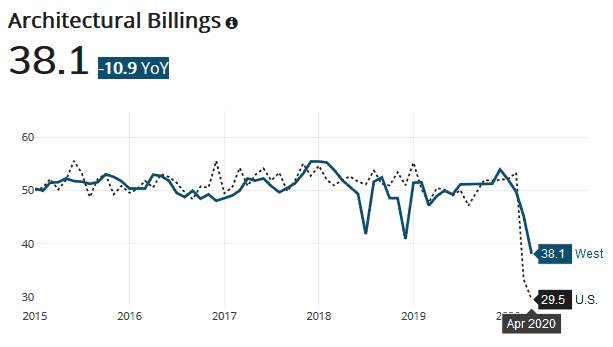

- The Architectural Billings Index fell to 29.5 in April, well below the low of 34.3 in early 2009. As we saw with the NAHB HMI, the survey’s West region outperformed the U.S. overall. Architecture firms are seeing a dramatic slowdown in activity, suggesting that the construction pipeline is not setting up for a swift recovery.

Click to expand image.

Housing Tides Media Insights

- The Denver Business Journal reports that leadership at Denver-based Re/Max expects the local housing market to enthusiastically rebound. Chief customer officer Nick Bailey explains that “Likely much of the spring selling season has simply been deferred, and we anticipate the velocity of transactions to increase in the coming weeks and months.” Sentiment: 0.43

- Realtor.com ranks Colorado Springs the “hottest market in the nation” for the third straight month. With better affordability for buyers priced out of Denver, Colorado Springs homes have received “about twice as many views as the average properties across the country.” Pueblo ranks number four on Realtor.com’s list as homebuyers extend their search even further afield in search of properties that match their budgets. Sentiment: 0.37

- The Wall Street Journal explains that the diversity of the Denver economy will make it resilient, positioning the Front Range for housing market strength for the same reasons that it was attractive before the pandemic. Still, the impacts to the leisure and hospitality and oil and gas sectors mean that the Colorado economy won’t get off scot-free. Sentiment: -0.34

- A discussion of the housing outlook appearing in the Denver Post was less optimistic, arguing that while home prices will be “sticky” and see minimal declines, construction activity “all depends on the virus” and the strong possibility of a second wave of infections suggests a “W” or checkmark-shaped recovery, not a “V.” Sentiment: -0.59

COVID-19 Will Be Around for a While

Will sunshine and warm weather bring an end to face masks and social distancing and other pandemic mitigation tactics? The easing of stay-at-home orders may be short-lived. Keep your face mask next to your iPhone. COVID-19 will be around for a while. Monitor the excellent COVID-19 dashboard updated daily by Johns Hopkins University for the latest information. You will be wise to plan for these scenarios:

- In the first scenario, a monster wave hit in early 2020. It will be followed by alternating mini-waves of much smaller outbreaks every few months with only a few cases in between.

- In the second scenario, the current monster wave is followed later by one that is twice as fierce and even longer-lasting, as the outbreak rebounds after a summer when a significant drop in the number of cases and deaths lead officials and individuals to let their guard down, relax physical distancing more than what was safe and to fail to detect the early warning signs that the new outbreak was gathering force. After this doubly disastrous second wave, the sea is almost calm marred only by a few small outbreaks.

- In the third scenario, the current wave creates a new normal with outbreaks of nearly equal size and duration through the end of 2022. At that point, the best-case scenario is that an effective vaccine becomes available to the population.

Planning Ahead

Keep a supply of masks and PPE, they will remain part of daily life for a while. You will see signs of recovery but don’t be discouraged if they turn out to be false hopes. Expect disruptions to your plans. Use Housing Tides to prepare new strategies and celebrate when you see them succeed. Housing is undersupplied. The demand is there for those of us in the housing industry who can manage the difficulties.

Ready to explore the depth of data in Housing Tides?

Sign-up for a Housing Tides account to access the interface and dive into the data!

For a limited time only, we're offering complimentary access to Housing Tides. Don't miss out!

About Jeff Whiton

Jeff formerly headed operations for Lennar and KB Home in Colorado building nearly two per cent of the state’s total single-family housing stock. He was honored as Colorado’s Home Builder of the Year in 2001. Whiton also served as the CEO of the Home Builders Association of Metro Denver for eight years reviving the association from near bankruptcy after the Great Recession.